RSG FINANCIAL GROUP INC is a global association of companies providing various services, including investment insurance, pension savings, diversification funds and deposits, economic cybernetics and protection of banking systems, software development, personal data protection, cryptography, data science, artificial intelligence, and blockchain technology. The RSG Trust & Investments brand specializes in providing modern financial solutions, data storage and transfer systems, and digital security.

The oldest company in the holding is RSG FINANCIAL GROUP INC, which was registered in 2000 as a closed joint-stock company. The company is engaged in holding activities, management consulting, technical testing and analysis, environmental consulting, professional, scientific and technical activities, business support services, IT services, engineering, as well as other activities auxiliary to insurance and pension provision.

To optimize the company's business processes and support its global presence, RSG Financial Group, Inc. created its own blockchain in 2015. In 2019, the State Financial Trading Chain was created based on this blockchain, which digitized its products and services, making them useful for any Web 3.0 user. The RSG protocol is currently used to protect confidential data and control transactions, reducing the possibility of price manipulation on exchanges with low liquidity, large market participants, institutional players, and high-frequency algorithmic programs.

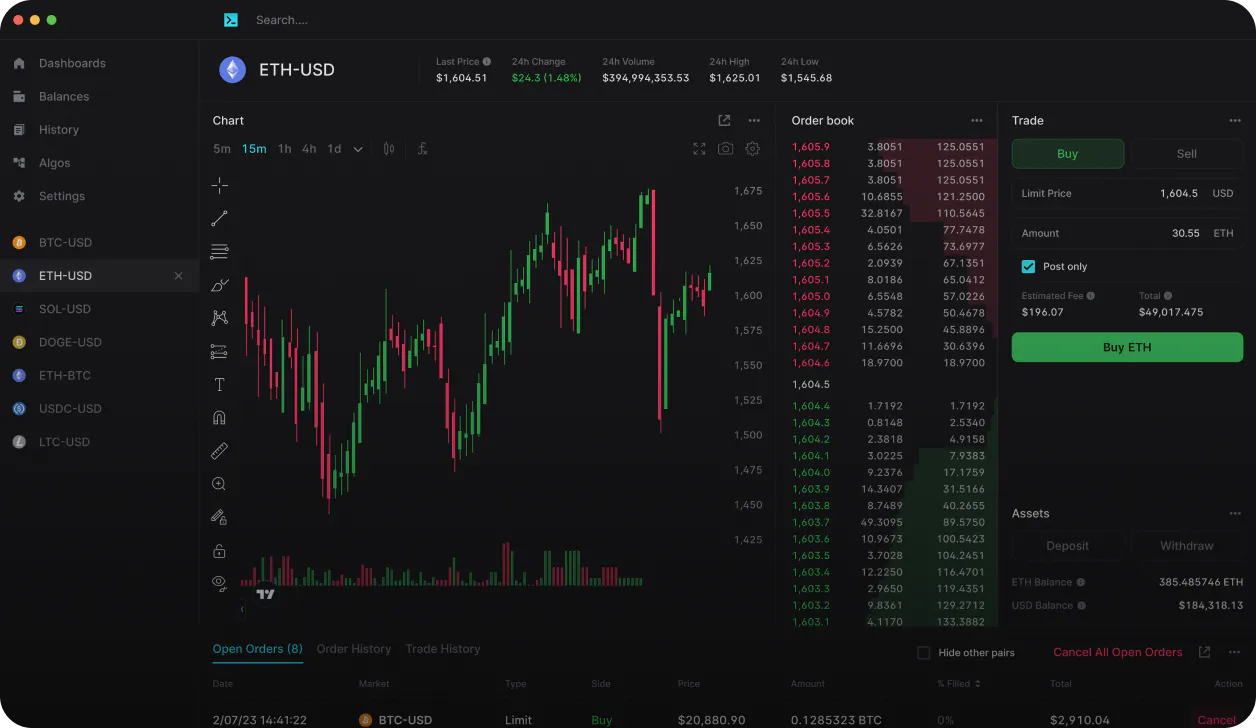

RSG Trust & Investments is a comprehensive blockchain-based financial solution offered by RSG Financial Group, Inc. The platform has a simple and intuitive interface, making it the ideal cryptocurrency exchange for beginners. The platform also offers a wide range of educational materials on cryptocurrency, including advanced trading strategies and the latest developments in decentralized finance (DeFi).

The RSG protocol is currently going through an audit, and once it passes, the source code will be opened and adopted by centralized and decentralized exchanges. The exchange is looking for an algorithm that will eliminate issues such as security, data leaks, fraud, and the influence of news on pricing.

General description of our companyRSG Financial Group Inc (also referred to as “we”, “us”, or “RSG”, or "RSG Trust & Investments") is an registered Investment Adviser.

Description of Advisory ServicesRSG investment advisory services are provided to clients through an appropriately licensed and qualified professional who is an investment advisor representative of RSG Trust & Investments. Your investment advisory representative may be an employee of RSG Trust & Investments or an independent contractor of RSG Trust & Investments. Your investment advisory representative is generally limited to providing services and charging fees for investment advice in accordance with the descriptions provided in this brochure.

RSG offers several types of consulting services designed to meet the individual needs of our clients. Below is a description of the main consulting services we offer.

Model Portfolio Solutions - RSG offers model portfolio selection services, which allows RSG Trust & Investments to exercise discretion to select model portfolios managed by third-party investment managers. A representative of the investment adviser will help you fill out a questionnaire with a client profile and analyze the information you provide. We will then select a sample portfolio (s) that fit your financial circumstances, risk tolerance and investment objectives. RSG Trust & Investments will use its discretionary authority to exercise selected model portfolio (s) and trade on your account based on information and/or signals provided by the model portfolio manager (s). We will be able to select the portfolio model (s) as well as reallocate funds from or to the portfolio model (s) and funds in other accounts for which you have granted us discretionary authority.

Direct Asset Management Services - When using direct asset management services, your investment advisor will individually select the cryptocurrencies held in your account as they please. We will have the right to buy or sell cryptocurrency on your behalf without your prior approval for each transaction. However, you will have the right to impose restrictions on the management of your account, including giving us instructions not to buy a certain cryptocurrency.

We will manage your account based on your financial situation, investment goals and risk appetite. Accordingly, we will need to obtain certain information from you to determine your financial situation, investment objectives, and risk appetite. As part of this process, a representative of the investment adviser will collect and analyze the information you provide. You are responsible for notifying us of any changes in your financial situation, investment objectives or risk appetite. You can also discuss with an investment adviser representative any restrictions on trading or owning crypto assets.

The financial position, investment objectives and risk tolerance of each RSG Trust & Investments client are unique. As a result, we may give other customers advice or act on their behalf that is different from the advice or actions we provide you. We are not required to buy, sell or recommend to you any crypto assets or other investments that we may buy, sell or recommend to other customers or to our personal accounts.

When allocating investment opportunities, conflicts can arise between the accounts we manage. We are committed to allocating investment opportunities that we deem appropriate to your account (s) and other accounts, consistent with the best interests of all accounts involved. However, there is no guarantee that a particular investment opportunity will be allocated in any particular way. If we obtain material non-public information about a crypto asset, we are not authorized to use or disclose that information.

Retirement Workshops – RSG holds complimentary workshops for prospective clients looking for more information about retirement, in general. These workshops usually cover a wide multitude of aspects and are for informational purposes only. No products are offered, discussed, or sold at these events. Attendees are given an opportunity to schedule an appointment with an adviser to discuss their situation and explore whether there is potential for a business relationship.

Tailor Advisory Services to Individual Needs of ClientsRSG Trust & Investments’ advisory services are always provided based on your individual needs. This means, for example, that when we provide asset management services, you are given the ability to impose restrictions on the accounts we manage for you, including specific investment selections and sectors.

We will not enter into an investment advisor relationship with a potential client whose investment objectives may be deemed inconsistent with our investment philosophy or strategies, or if the potential client seeks to impose overly restrictive investment rules.

Participation in fixed fee programsIf RSG is your primary advisor, our solutions for sample portfolios are provided on a flat fee basis only. Thus, you will only pay a fee based on the amount of assets under management, and will not pay a separate fee, processing fee or storage fee for completing transactions in your account. RSG Trust & Investments and certain service providers, including the depository and model portfolio manager, will receive a portion of the fee as a fee for their services.

Customers will also be responsible for paying transaction costs and fees to the extent applicable. You will also be responsible for paying various fees charged by your account custodian, including platform fees, bank transfer fees, transfer fees, bank fees and other fees, as well as fees and expenses that are included in the expense ratio of certain investments, including mutual funds and ETFs.

You'll pay fees and expenses whether you're profiting from your investments or suffering losses. Make sure you understand the fees and expenses you pay.

Fees for Advisory Asset Management ServicesThe total annual asset management advisory fee (the "Advisory Fee") payable to our company is subject to negotiation at our company's discretion and will be specified in the Investment Advisory Agreement signed by the client and our company. The maximum annual consulting fee charged for these services will be between 9% and 11% of the total profits for all assets under management and will include all fees payable to consultants unless otherwise agreed by you in a separate written agreement.

Consulting fees are usually billed monthly at the end of the month based on the average daily balance on each invoice for the previous calendar month, depending on the consultant recommended. The first monthly fee is calculated in proportion to the remainder of the month. Consulting fees are negotiable and will be deducted from the customer's account (s) by either us or the consultant. In rare cases, our company agrees to bill customers directly.

Transfer and transfer recommendations to RSG Trust & InvestmentsOur company has an inherent conflict of interest in recommending the transfer or transfer of your accounts to an account managed by us because we are interested in receiving rewards for the company.

When we provide you with investment advice regarding your account or individual retirement account, we are proxies, as appropriate, which are the laws governing retirement accounts. The way we make money creates some conflicts with your interests, so we operate under a special rule that requires us to act in your interests and not put our interests ahead of yours.

In accordance with the provisions of this special rule, we are obliged to:

- Comply with professional standards when providing investment advice (give reasonable advice);

- Never put our financial interests ahead of yours in providing advice (giving loyal advice);

- Avoid misleading statements about conflicts of interest, commissions and investments;

- Follow policies and procedures designed to ensure that we provide advice that is in your best interest;

- Charge no more than a reasonable fee for our services;

- Provide you with basic information about conflicts of interest.

RSG Trust & Investments typically provides investment advice to the following types of clients:

- Individuals

- High-income individuals

- Pension and profit sharing plans

- Companies or other entities not listed above

RSG Trust & Investments uses the following analysis methods when formulating investment recommendations:

Graphical analysis is a technique used in technical analysis in which graphs are used to show price movements, volume, estimated prices, open interest, and other measures in order to predict future price movements. It is believed that past trends of these indicators can be used to extrapolate future trends.

Graphical analysis is subjective because it is based on the correct interpretation of graphical models. The risk of using graphical models is that the next day's data may refute the conclusions drawn from previous day's models.

Cyclicality - this method analyzes investments that are sensitive to business cycles and whose effectiveness is related to the overall economy. The price of the cyclical company's crypto assets may rise just before the economic recovery begins and fall just before the downturn begins. Investors in cyclical crypto assets are trying to buy cryptocurrency at the low point of the business cycle, just before the start of the turning point.

While many economists agree that there are cycles in the economy that must be considered, the length of such cycles is generally unknown. A purchase decision at the low end of the business cycle may turn out to be a transaction that occurs before or after the low end of the cycle. If the transaction is made to a low point, then a drop in price may occur before making a profit. If the transaction is made after the low point, then part of the price increase may be missed. Similarly, a sale decision to be made at the top of the cycle may result in a lost opportunity or unrealized loss.

Fundamental analysis - This method evaluates a crypto asset by attempting to measure its intrinsic value by examining related economic, financial, and other factors. Fundamental analysts are trying to study everything that can affect the value of cryptocurrency. The ultimate goal of doing fundamental analysis is to get a value that an investor can compare to the current price of a cryptocurrency in hopes of determining what position to take on that cryptocurrency (undervalued = buy, overvalued = sell or short). The fundamental analysis is to use real data to estimate the value of the cryptocurrency.

The risk associated with fundamental analysis is that the analysis may be somewhat subjective. While a quantitative approach is possible, fundamental analysis can include a qualitative assessment of how market forces interact with each other, influencing the investments in question. These market forces can point in different directions, which requires an interpretation of which forces will be dominant. This interpretation may be misguided and therefore lead to an adverse investment decision.

Technical analysis - This method evaluates cryptocurrencies by analyzing statistics derived from market activity, such as past prices and volumes. Tech analysts are not trying to measure the intrinsic value of cryptocurrency, but instead are using graphs and other tools to identify patterns that could predict future activity.

Technical analysis is subjective, since it is based on the correct interpretation of data on the price and volume of trade in a given cryptocurrency. A decision can be made on the basis of historical movement in a certain direction, accompanied by the volume of trading; however, this volume may only be larger compared to the past trading volume of a given cryptocurrency, not compared to the future trading volume. Therefore, there is a risk of making an incorrect trading decision, since the future trading volume is unknown. Technical analysis is also done by observing various measures of market sentiment, many of which are quantitative. The risk of using such sentimental technical measures is that very optimistic indicators can always become even more optimistic or pessimistic, which will lead to a missed opportunity if the consultant decides to act on the signals and sell or buy the position.

To conduct the analysis, RSG Trust & Investments collects information from financial newspapers and magazines, reviews the activities of companies, examines research materials prepared by others, company rating services, timing services, annual reports, prospectuses and documents filed with the SEC, as well as press releases of companies.

Investment strategiesRSG Trust & Investments may use the following investment strategies when managing client assets and/or providing investment advice:

Investing in cryptocurrency. The strategy of investing in cryptocurrency involves the choice of cryptocurrencies that are traded at a price below their intrinsic value. Investors using this strategy typically look for cryptocurrencies of companies they believe are undervalued by the market. They believe the market overreacts to good and bad news, leading to cryptocurrency price swings that fall short of the company's long-term fundamentals. As a result, value-driven investors have the opportunity to profit by buying cryptocurrency when its price goes down. Risks associated with investing in value include incorrect analysis and revaluation of the intrinsic value of the business, concentration risk, low profitability compared to the main benchmarks, macroeconomic risks, investing in "value traps" (i.e. companies that remain consistently undervalued) and the loss of purchasing power of cash in the event of inflation.

Tactical asset allocation. A tactical asset allocation strategy allows for a range of percentages in each asset class (e.g. cryptocurrency = 40-50%). Ranges establish minimum and maximum acceptable percentages that allow an investor to use market conditions within these parameters.

Strategic asset allocation. The strategic asset allocation strategy involves setting allocation targets and then periodically rebalancing the portfolio in line with these targets, as the return on investment may result in a deviation from the original asset allocation percentages. The concept is closer to a buy-and-hold strategy than an active approach to trade. Of course, strategic asset allocation targets can change over time, as client goals and needs change, and the time horizon for important events such as retirement and university funding decreases.

Selection of model managersRSG Trust & Investments uses model managers who have been vetted by AE Wealth Management ("AEWM") and included in their model program. AEWM is conducting an initial and ongoing review to ensure that the model manager is suitable for our program.

Risk of lossInvesting in cryptocurrencies always carries a risk of loss. Depending on the types of investments used, the degree of risk may vary. Accordingly, you should be prepared for investment losses, including the loss of the original investment amount. Past performance is not a measure of future performance, so you should never assume that the future performance of any particular investment or investment strategy will be profitable.

Due to the risk of losses associated with investing, our company cannot claim, warrant, or even imply that our services and analysis methods can or will predict future results, successfully determine market peaks or dips, or protect you from losses resulting from market corrections or dips.

Sale of insurance productsOur representatives may sell other products or provide services unrelated to their functions as investment advisor representatives in our company. In line with our company's financial planning philosophy, our financial professionals often recommend that customers use insurance products (e.g. fixed index annuities (FIAs)) within a customer's overall financial plan instead of separately managed accounts (specifically, instead of cash and fixed income assets). You should be aware that due to our planning philosophy and recommendations for the use of insurance products of this kind, there are a number of conflicts of interest.

According to rough estimates, our financial professionals registered as representatives of investment advisers will spend approximately 50% of their time in the future selling insurance products and providing insurance services and 50% of their time providing investment consulting services.

As such, you can work with your financial professional both as an investment advisory representative for RSG Trust & Investments and as an insurance agent. In this capacity, your finance professional RSG, acting in the dual role of IAR and insurance agent, can advise you to purchase insurance products (general disability insurance, life insurance, annuities and other insurance products) and then assist you in implementing these recommendations by selling you the same products.

When acting as an insurance agent, a financial professional usually receives a commission for selling these products to you. Recommending a customer to purchase an insurance product through them as an insurance agent is a conflict of interest, as receiving a commission is an incentive to recommend products that can be selected based on commission rather than your personal needs and goals.

In addition, commissions may vary by product, and each individual product may have different commission rates, prompting the finance professional to recommend products that may generate higher revenue and fees for products that are most appropriate for you.

StorageCustody means access to or control over a customer's funds and/or assets. Storage is not limited to physical storage of customer funds and assets. If an investment advisor has access to or control over a client's funds or assets, they are considered custodians and must ensure proper procedures are followed. It should be noted that permission to trade in customer accounts is not considered a custodian by regulators.

RSG is also considered the custodian of customer funds as we allow the use of standing powers of attorney in customer accounts. For accounts for which RSG is considered a custodian, we have established procedures to ensure that all customer funds and assets are held by a qualified custodian in a separate account for each customer under that customer's name. Account statements are delivered directly from a qualified custodian to each customer or independent customer representative at least quarterly.

In conclusion, RSG Trust & Investments is a combination of companies providing a wide range of services around the world, including insurance of investments, pension savings, diversification funds and deposits, as well as various technical and professional activities. The exchange's simple interface and extensive training materials make it an ideal cryptocurrency exchange for beginners.

RSG Trust & Investments offers greater functionality rather than just buying and selling cryptocurrency. It facilitates transfers and offers payment solutions, unleashing the potential of making sophisticated crypto transactions.

RSG Trust & Investments is the fastest-growing, reliable and secure cryptocurrency trading platform, making an impact by increasing economic freedom on a global scale.

Join us and start trading confidently with us!

Trade Now

- Low fees, no gas costs Once you deposit to Layer 2, you will no longer pay fees to miners for each transaction.

- Lightning quick Trades are executed instantly and confirmed on the blockchain within hours.

- Fast withdrawals Unlike other platforms, there is no wait required to withdraw your funds from Layer 2.

- Mobile friendly We've redesigned our exchange from the ground up, so you can use it from any device.

- Secure & private StarkWare's Layer 2 solution provides increased security & privacy via zero-knowledge rollups.

- Cross-margining Access leverage across positions in multiple markets from a single account.

- Safety Stability Multi-tier & multi-cluster system architecture

- High Liquidity Abundant resources and partners

- All Devices Covered Support Web, Android, Html5, PC

- Multiple-Coin Support We've redesigned our exchange from the ground up, so you can use it from any device.

- Proven Products The underlying RSG Trust & Investments platform has been deployed on 30+ exchanges already. It supports all devices and multiple languages, offering a seamless user experience.

- Industry Resources Whe have solid relationships with industry leaders, simply look at the list of investors and advisors who are willing to stand behind our platform.

Adrienne During

Corporate Counsel

Before joining RSG Trust & Investments, Adrienne served as Executive Vice President of Compliance at FTX US, as well as Executive Director of Technology Compliance at The Depository Trust & Clearing Corporation, where she focused on developing processes and controls to monitor and maintain DTCC’s compliance with global technology requirements. Adrienne began her legal career at Sidley Austin in New York. She holds a J.D. from Fordham University and B.A. in Policy Analysis and Management from Cornell University.